This post is sponsored by Capital One. All thoughts and opinions are my own.

I don’t know about you, but I wasn’t a born negotiator.

If I’m honest, I wasn’t the best negotiator just five years ago even as a personal finance educator. This was an area I desperately wanted to improve in because I was tired of feeling that I’d always need “support” – especially from a male family member or friend – if I wanted to get the best deal on a purchase as important as a car.

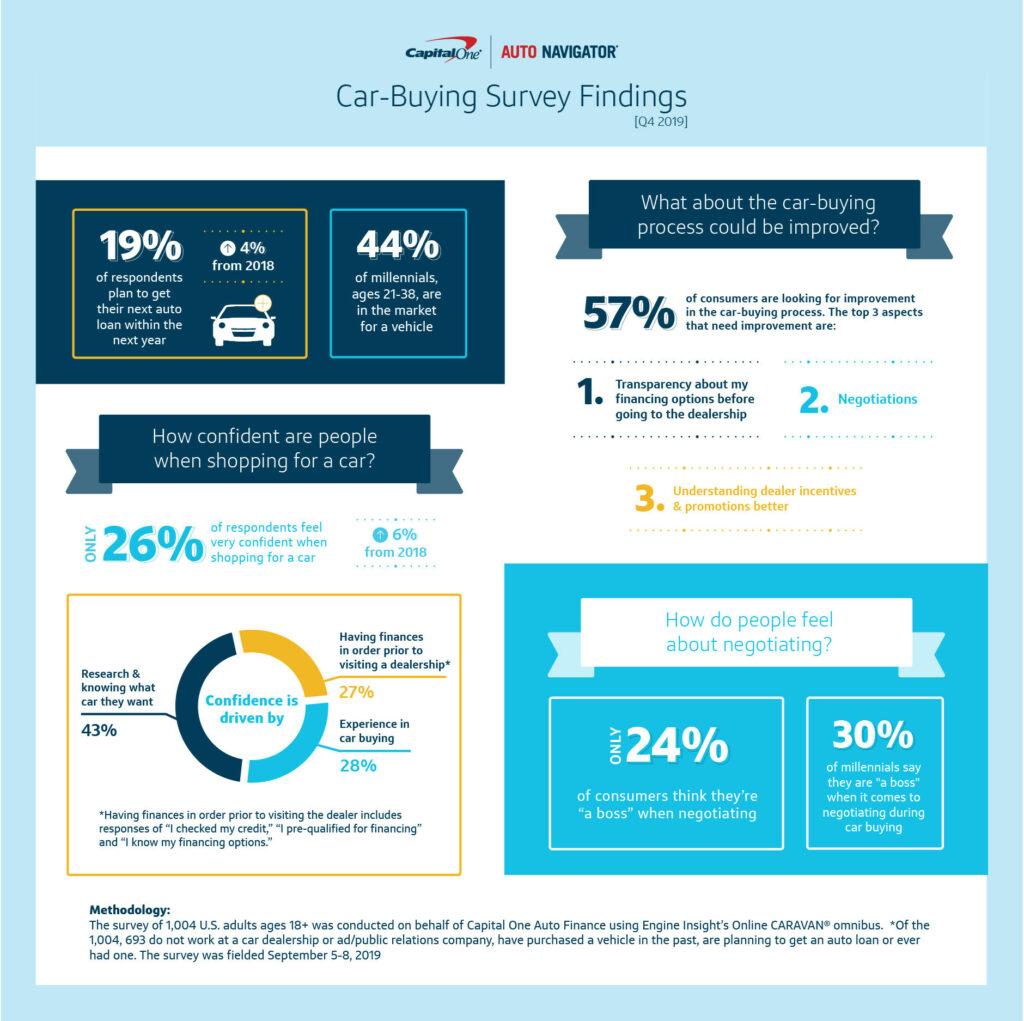

After reading the second annual Car-Buying Survey from Capital One Auto Navigator recently, I know other people feel this way too. Only 24 percent of survey respondents believe they are “a boss” when it comes to negotiating during car buying and most don’t feel very confident about car shopping at all – only 26% of those surveyed feel very confident when shopping for a car.

I bet I’m not alone in feeling that being more prepared is the key to showing up confidently to negotiate that next car purchase.

Here’s what ultimately helped me prepare when I negotiated my first car purchase:

Knowing my starting point (aka being pre-qualified). According to the Car-Buying survey, 88 percent of consumers understand what it means to pre-qualify for financing, but only half are willing to try it. Big mistake! You should always begin the car buying process with pre-qualification – just like you would in a home purchase. I started with Capital One’s Auto Navigator because it allowed us to see how much I could pre-qualify for in minutes with no impact to my credit score. This is huge because I remember as a mortgage broker in my former life how shopping around could cause hard inquiries that would drop a client’s score 5-10 points per inquiry. If you’ve gone to 3-4 dealerships within a week or two, you’re talking up to 30 points that could make the difference in the interest rate you receive and therefore, how much you pay over the life of the loan. Hard inquiries matter and Auto Navigator insulates you from this. What was also helpful was the personalized financing information I received once pre-qualified. By using Auto Navigator, I was able to see my personalized APR and monthly payment on each car I found in the digital inventory of nearly four million cars at almost 13,000 participating dealers across the nation. Talk about time saved!

Committing to MY budget – NOT my emotions. Knowing my numbers was a blessing to the “Money Maven” side of me and a curse to regular ‘ol Patrice who can get caught up in my feelings. Once I knew what I was pre-qualified for, I had to judge it against our actual budget which factors in our entire financial picture. I couldn’t unsee what I saw which means I didn’t get swept away in the allure of a million test drives that in the end weren’t going to be best for us. What most of us do is go to a dealership unprepared financially or emotionally and let our feelings get the best of us. We fall in love with leather seats, features we’ll likely never use and the new car smell and forget that there’s more to a car. 75 percent of those survey respondents put budget in their top three elements to consider when buying a car, but I’d venture to say that most people said budget because it sounds responsible. How many times have you known logically what you could or couldn’t afford, but when it came down to it, you got in over your head because your emotions whispered, “But we work hard and we deserve to get everything we want?” It happens to the best of us, but if you make the decision beforehand to actually commit to the budget no matter what, it’s easier to keep your head in the game and look at the greater impact on your budget overall.

Removing desperation from the equation. Whether it’s car buying or negotiating my next contract, I’ve learned that to be a successful negotiator you have to be willing to walk away. Once I know my numbers and I’m committed to what is truly best for me and not to simply letting my emotions get the best of me, then I realize there’s no rush. I had a mentor tell me once that while time is of the essence, the truth is “time is on our side.” When we operate from a place of desperation, the other side can smell it. There’s a quiet strength that speaks loudly to the other side when they realize you understand that there are plenty of options on the market and you can take it or leave it. Having patience, not being in such a rush to close and being the most flexible with time will always provide the advantage. You’ll end up receiving concessions to incentivize you to close the deal because unlike you, the average person on the other side of the table is in a rush to get something closed.

What’s helped me get better over the years is arming myself with the right numbers, doing my best to remove emotion and being diligent about my research upfront. Ultimately, what we’re all looking for is more confidence in the car buying process and anything else that requires us to sharpen our negotiation skills. Auto Navigator from Capital One is a product that ensures we as consumers have the information needed to confidently find and finance a car. Now we just have to do our part to strengthen how we negotiate.